Recognising ‘value for money’ in pension default funds

Identifying which pension providers offer consistent value for money is complex.

TPR recognises that there’s no common definition of what constitutes value for money because employers, trustees and scheme members place different values on the components of a scheme. However, they have described value for money in a DC pension scheme as follows:

‘A scheme offers value for money (VFM) where the costs and charges deducted from members’ pots or contributions (the costs of membership) provide good value in relation to the benefits and services provided (the benefits of membership), when compared to other options available in the market. It does not necessarily mean low cost, provided higher costs can be justified by improved benefits.’

When it comes to pension default schemes where members have high expectations of fund performance but little engagement in the investment process, the notion of value is especially important. Advisers and their clients are left with an important question: how do you ensure that any pension default scheme you recommend offers value when there is no universally agreed measure for it?

After all, advisers put their reputation on the line with every recommendation they make.

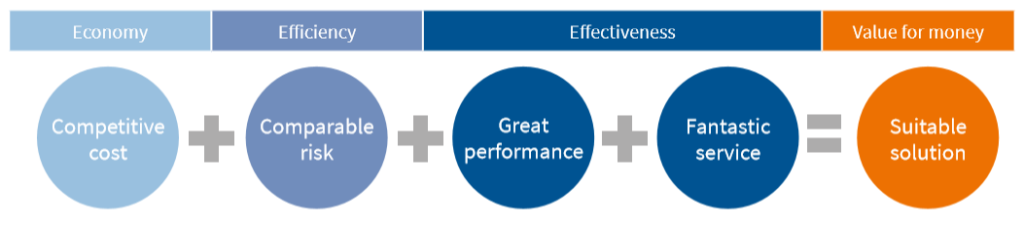

Nest, the award-winning pensions provider, has sponsored a guide [insert link to report] by Defaqto exploring what an adviser needs to know in order to rank workplace pension default funds. Defaqto’s impartial experts believe there are four headline factors that define value for money.

Nest have undertaken extensive research on what constitutes value for money, delving into the needs of the scheme’s membership. It also regularly reviews its performance against other major auto enrolment providers, ensuring its offering and benefits remain competitive in a crowded marketplace. Want to see how Nest stacks up against the rest when it comes to value for money? Read Defaqto’s guide on ‘How to analyse workplace pension default funds’.

Want to see how Nest stacks up against the rest when it comes to value for money? Read Defaqto’s guide on ‘How to analyse workplace pension default funds’.