A Positive second quarter …

The second quarter of 2023 has continued the positive trend we saw at the start of the year, with markets gaining confidence and posting positive returns. Previous concerns of recession have so far not materialised as global growth remains more resilient. However, high inflation coupled with strong labour markets means raised expectations for interest rates in developed countries which has affected bond market returns.

Higher interest rates and how much consumer spending and corporate investment react to them are likely to dictate the coming months, determining whether economies enter recession. The economic outlook remains uncertain but, as always, we are monitoring markets closely.

In Q2 2023 our funds achieved similar positive returns to those in Q1 which has significantly reduced the extent of the one-year negative returns.

Strength in diversification

We still believe that well diversified funds are the best strategy by which we can deliver good, inflation beating returns for our members over the long term. We will continue to evolve and improve the sophistication of our award-winning default fund strategy. This will include increasing the proportion of our assets that are invested in private markets as well as the introduction of new asset classes like natural capital which could provide additional diversification to our portfolio.

It’s also worth remembering that most of our members benefit from contributions from their employer and another contribution to their pot from the tax relief they receive.

Our Award winning strategy

We’re very pleased to have won the ‘Best investment strategy’ award at the 2023 European Pensions Awards last month. Our recent victory means that it’s now the third successive year we’ve been victorious in this category, showing the expertise and knowledge within the Nest Invest team.

Our performance vs the market

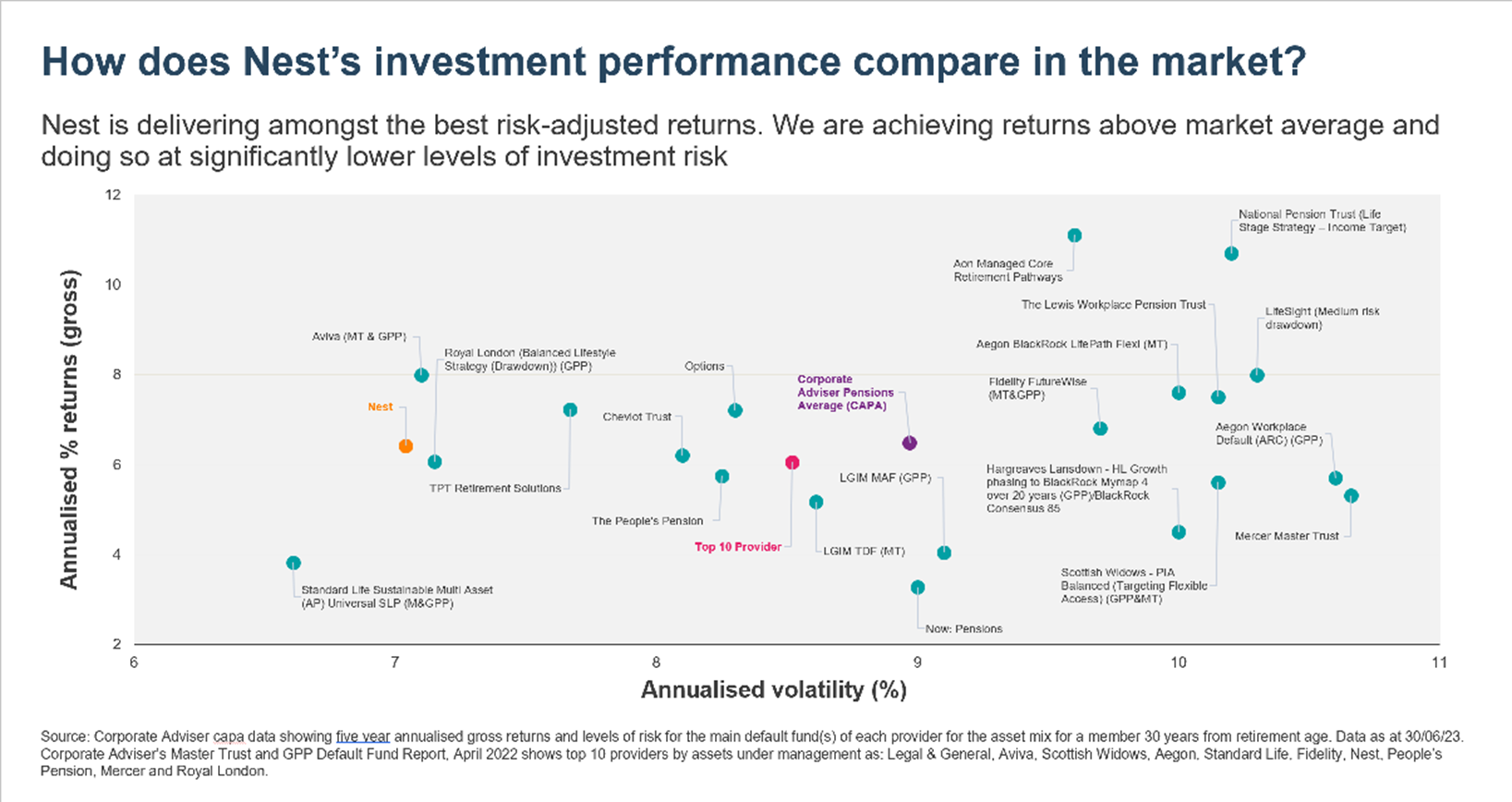

Capa have published the risk and return figures for most pension providers at 30 June 2023. The chart below shows 5-year gross annualised risk and return figures for a member 30 years from their retirement date – so in Nest’s case they will be invested in our Growth asset allocation. The chart shows Nest is delivering returns in line with market average but doing so whilst taking significantly less investment risk than most other pension schemes and providers. Nest’s figures compare particularly well with most of the other top 10 pension providers where we have delivered above average returns, again at lower risk.

Nest now invests over £30bn on behalf of our 12 million members, making Nest one of the biggest pension schemes in the UK and giving our members access to the kind of investments that are usually only available to the largest investors, including investments that aren’t listed on the market. Our members also benefit from deals that only large investors get, allowing us to keep our charges low. And by keeping charges low, more of members’ money gets invested, meaning there’s more to grow.