Performance highlights

› Nest funds performed well again in quarter 2 2021. Nest’s 2040 fund, which is representative of all our funds in the Growth stage, gained 5.4% in quarter 2. The exceptional yearly performance figures to 30 June 2021 continue to reflect the fact that this time last year markets were recovering from the spring 2020 Covid volatility.

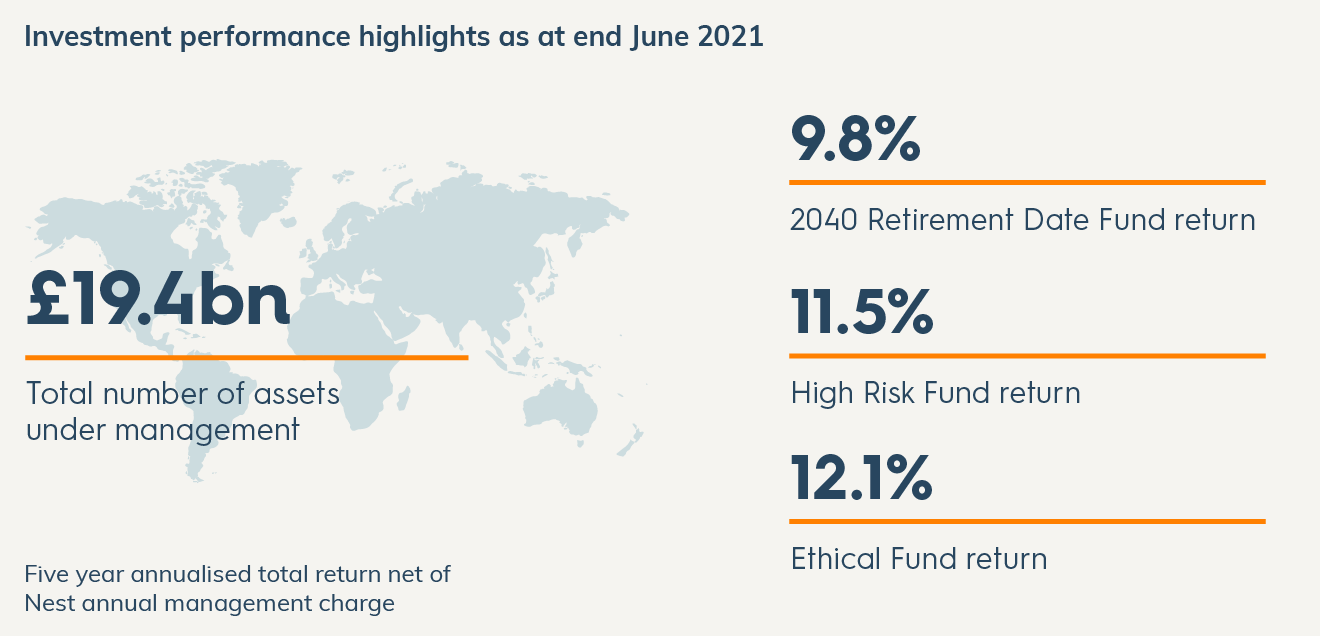

Perhaps the headline is the fact that despite market volatility, members in the growth stage of their savings with Nest have received annualised returns over the past 5 years of 9.8%. That compares very favourably with many other pension and ISA products and certainly with deposit account rates. This has been achieved in addition to protecting members close to retirement from market volatility by the de-risking inherent within our Consolidation phase.

At 30/6/21 the annualised return from our Growth fund, since launch in 2011, is an impressive 9.4%.

Nest now invests over £19.5bn on behalf of our members, making Nest one of the biggest pension schemes in the UK and giving our members access to the kind of investments that are usually only available to the largest investors, including investments that aren’t listed on the market. Our members also benefit from deals that only large investors get, allowing us to keep our charges low. And by keeping charges low, more of members’ money gets invested, meaning there’s more to grow.

Please click here to access the full QIR report.

Responsible Investment highlights

› In April we published our latest responsible investment report ‘Investing for a better future’. Responsible Investment with Nest Pensions | Nest Pensions

During quarter 2 Nest has been active in voting at company AGMs. Pension schemes invest members’ money into some of the largest companies in the world. That means pension scheme members are part owners of businesses such as Microsoft and Samsung. On members’ behalf we’re able to vote in a way that promotes long-term sustainable growth and then follow up afterwards to check progress. Over the past year Nest engaged with 266 companies on how they operated and voted more than 58,000 times at AGMs, enabling us to press for change if we felt it was needed. A good example is ExxonMobil where we want them to set stronger carbon reduction targets and start planning for a transition away from fossil fuels. At their AGM in May, an investor challenged its executive board, leading to a ‘shareholder rebellion’ over ExxonMobil’s failure to set a strategy for a low-carbon future. The vote meant two ExxonMobil board members failed to be re-elected, and instead two other candidates were elected on the promise to help drive the company towards a greener strategy. Nest used its votes to help support the shareholder rebellion and we’re pleased with the outcome. It’s a potential watershed moment in the dynamic between company boards and shareholders.

We have also engaged with Barclays and HSBC to encourage them to reduce financing polluting industries, particularly coal and oil sands. We’ve also been active with Tesco, Morrisons and the food industry in general, to encourage further alignment with a global agenda on healthier and more environmentally sustainable foods.

Market movements and our response to them

› Latest data show economies performing well but with signs of rising inflation. Central banks face difficult judgements on when to withdraw support and raise interest rates – delay and risk more permanent inflation, or do it too soon and risk further economic recovery. It’s a fine balancing act.

The Nest investment approach is designed to take care of market movements and volatility so that our members do not have to worry.

› This is because our approach to asset allocation is strategic, not tactical, and designed to deliver our target returns over the long term. Strategic asset allocation is proven to be the biggest driver of long-term returns. Nest approaches this by constructing reference portfolios that should, based on forward-looking modelling, achieve our investment objectives for each phase of members’ savings journey. For example, our Growth Phase, where members will be saving from their late twenties to around 10 years before their selected retirement date, aims to grow members’ pots by 3% more than inflation after all charges. This portfolio therefore holds around 60% in global equities, based on its strategic asset allocation targets. However, our in-house FCA regulated subsidiary Nest Invest, has delegated authority to adjust the portfolios within set tolerances.

› We have recently slightly increased our weightings of commodities and emerging market equities, whilst decreasing high-yield bonds, in response to market conditions. These tweaks aim to dynamically maximise returns based on prevailing market conditions by either ensuring the actual portfolio sticks more closely to the reference portfolio or by taking account of significant shorter-term trends that may affect the long-term outlook. We have also now added infrastructure and private markets to our strategic asset allocation and real portfolios. Nest’s strategic approach to asset allocation is so far delivering well for our members.

Our goal is to help members achieve a bigger pension in a better world.

The value of investments may go down as well as up and the return of your investment is not guaranteed. Fluctuations in financial markets, currencies and other risks may cause fluctuations in the value of investments. Any fund objective or target should not be considered as guarantee of performance of any fund. Derivatives may also be used for efficient portfolio management purpose.

This document does not constitute advice on whether to invest in these funds. Neither this document nor any data contained within this document is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. You may wish to consult with an appropriately qualified financial adviser in relation to your investments and any change to them.

This document has been created by National Employment Savings Trust (Nest). This document is valid as at the date of its publication. This document and data contained within this document is provided for information purposes only and may not be reproduced or extracted or used for any other purpose.

This document includes and/or is based on data that is owned by and obtained from third party sources. Data from third party sources is provided “as is” and is not verified by Nest. Additional disclaimers which apply to the third party data are available on our website nestpensions.org.uk

No undertaking is given, or representation or warranty is made, express or implied, by Nest or by any third party source that the information in this document is current, accurate, complete or error free, and the information must not be relied upon as such. Neither the third party sources nor Nest accept responsibility for any loss caused to any recipient of this document as a result of any error, inaccuracy or incompleteness of this document or as a result of any third party data.

© Nest Corporation 2021

* The transaction costs include both explicit and implicit costs (where applicable)