In the 10 years since we launched, we’ve grown to be the UK’s largest workplace pension provider by number of members. Over 90,000 new employers chose Nest in 2021 – and we think it’s because we continue to put you and your clients’ needs at the heart of our offering.

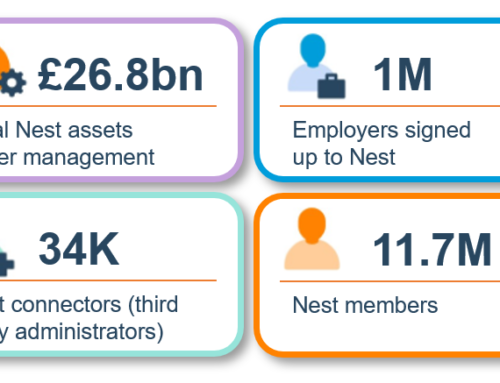

- 954,000 employers managed by Nest

- 10.8 million members

- 31,000 Nest Connectors

- £23.1 billion assets under management

Our performance over 2021

When we set up our flagship fund, our goal was to not only match inflation but beat it by 3% year-on-year.

Last year, our 2040 Nest Retirement Date Fund saw returns of 14.3%.

It’s further proof that our members’ money is in good hands, and a key reason you can recommend Nest to your clients with confidence. See how all Nest funds are performing in our latest quarterly investment report.

Making it easier to change workers’ records

Previously, Nest Connectors only had six weeks to edit workers’ details after enrolment. Many of you told us that wasn’t enough time to catch out errors in the enrolment process, so we’ve extended this. You’ll now have as long as you need to change these records.

Remember, you won’t be able to update details once a member has registered online. This remains unchanged from before.

Helping employers increase staff engagement

There’s been a marked rise in employers wanting to promote their workplace pension as a valuable employee benefit. That’s why we created the pension communications toolkit.

It’s packed with everything an employer needs to get workers engaged with their pension, from posters, flyers, emails and more. What’s more, communications have been crafted for specific employee life stages, giving employers free, accessible documents for new starters, those looking to retire, and everyone in between.

An award-winning pension scheme

Our first member invested £19 in 2011. Since then, we’ve grown that to £46.22 – a 143% increase. It’s testament to an innovative investment strategy that works hard to grow members’ money.

We think our strategy is a winning one, so it’s great when our peers agree. We were delighted to win the Ultimate Default Fund and Best Default ESG Strategy in 2021.

Ultimate Default Fund winner

Judges said our approach ‘not only ticks all the boxes but sets the standard for others to follow.’ The judges also commented on our market-leading diversification, strong performance history and said that Nest ‘stood out for its strong ESG credentials’. Judges were also impressed by the innovative approach of our Nest Guided Retirement Fund, which provides members with ongoing risk management through their retirement.

Best Default ESG Strategy winner

Judges said we had shown that responsible investment is an integral part of risk management. Our climate change policy, investment in green energy and our transitioning funds to net-zero were all positive developments recognised by judges.

A 5-Star rating for 5 years running

Independent experts Defaqto have awarded us a 5-Star rating for the fifth year in a row. We’re proud to be recognised for delivering one of the highest quality workplace pension schemes in the market.

Climate change remains a hot topic

Rules and regulations around climate change are rapidly changing as the government works to limit global warming. By 1 October 2022, pension schemes with £1bn or more of assets will be asked to follow the Taskforce on Climate-related Financial Disclose (TCFD) recommendations on managing climate risks.

As the one of the first UK pension providers to commit to stop investing in harmful fossil fuels and to actively work towards meeting the Paris Agreement, our governance and investment strategy more than fulfil TCFD expectations. See how we’re working to stop climate change from shrinking our members’ pension pots.

Auto enrolment earnings limits for 2022/23

Auto enrolment thresholds have all been frozen at 2021/22 levels. For the first time, from 6 April 2022, the auto enrolment lower earnings limit will no longer match the limit the government uses to calculate National Insurance contributions.

The auto enrolment earnings trigger determines when eligible workers are automatically enrolled into a workplace pension, so this freeze reflects the balance that needs to be struck between affordability for employers against helping workers save a meaningful amount for their future. The government expects this will trigger an extra 17,000 workers into saving.

| Pay period | Auto enrolment lower earnings level | Auto enrolment upper earnings level | National Insurance lower earnings level | National Insurance upper earnings level |

|---|---|---|---|---|

| 1 week | £120 | £967 | £123 | £967 |

| Fortnight | £240 | £1,934 | £246 | £1,934 |

| 4 weeks | £480 | £3,867 | £492 | £3,867 |

| Monthly | £520 | £4,189 | £533 | £4,189 |

| Quarterly | £1,560 | £12,568 | £1,599 | £12,568 |

| Half-Yearly | £3,120 | £25,135 | £3,198 | £25,135 |

| Annual | £6,240 | £50,270 | £6,396 | £50,270 |